5 Fehler, die Startup-Gründer bei der Erstellung eines Term Sheets vermeiden müssen

Vermeiden Sie die häufigsten Fehler, die Gründer bei der Aushandlung eines Term Sheets mit Investoren machen.

Antworten auf Ihre brennenden Fragen zur Startup-Finanzierung - Startup-Analysen, Einblicke und mehr

In diesem Beitrag werden wir versuchen, einige der wichtigsten, immer wiederkehrenden Fragen zur Finanzierung von Start-ups zu beantworten. Außerdem geben wir Ihnen Statistiken, Einblicke und bewährte Verfahren an die Hand, die Ihnen bei der Kapitalbeschaffung für Ihr Startup helfen.

Der Markt für Startup-Investitionen ist so stark wie seit Jahren nicht mehr. Doch wie Sie vielleicht schon auf die harte Tour gelernt haben, ist die Mittelbeschaffung für Start-ups auf jedem Markt eine unerbittliche Herausforderung. Nichtsdestotrotz gibt es bewährte Methoden, um sich vorzubereiten.

Einer der besten ersten Schritte ist es, so viel wie möglich über den Fundraising-Prozess selbst zu lernen. Um Ihnen dabei zu helfen, stellen wir Ihnen im Folgenden zunächst einige verblüffende Analysen zur Startup-Finanzierung vor. Danach werden wir uns eingehend mit den Unterschieden zwischen den verschiedenen Phasen der Startup-Finanzierung befassen. Wir beginnen mit der entscheidenden Unterscheidung zwischen der Angel/Seed-Runde und der Serie A-Runde. Dann werden wir untersuchen, was nach der Serie A liegt und wie viele Finanzierungsrunden Ihr Startup anstreben kann oder sollte.

Schließlich helfen wir Ihnen, Ihre Nische, Ihren Standort, Ihr Investitionsstadium, Ihr berufliches Netzwerk und Ihren Bedarf an Mentoren zu berücksichtigen, um die Liste der idealen Investoren einzugrenzen, die Sie heute ansprechen können.

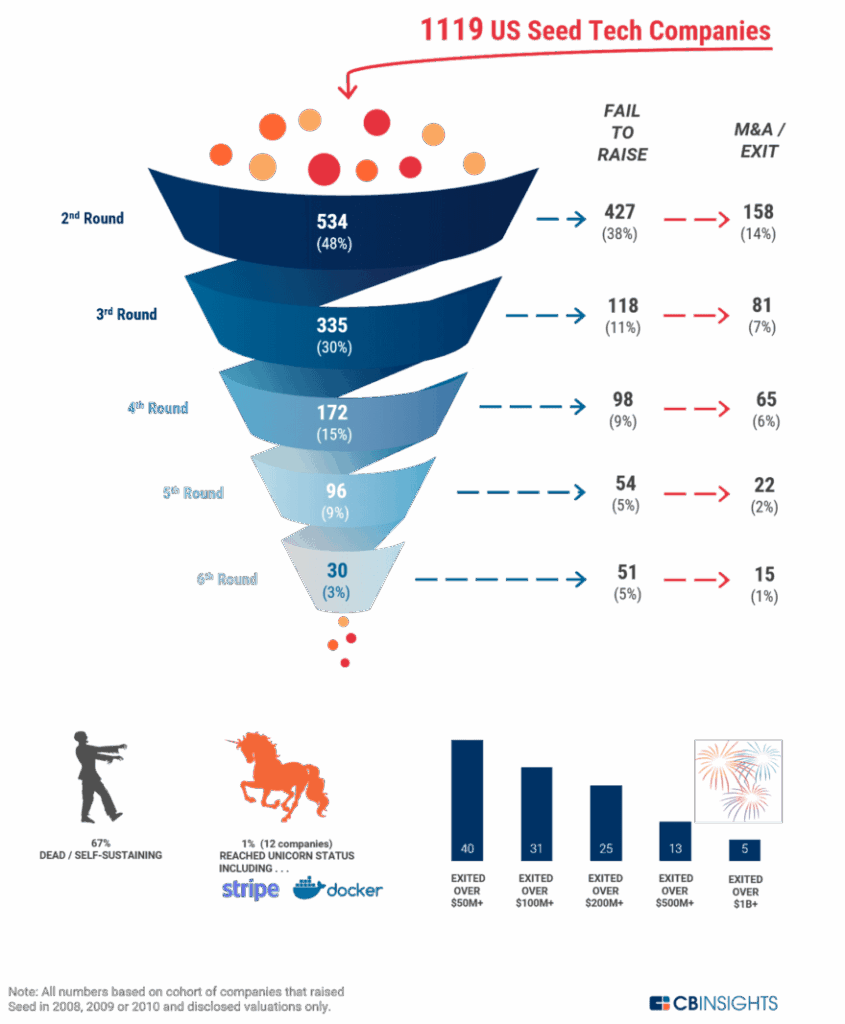

Nachdem CB Insights über ein Jahrzehnt lang mehr als tausend US-Start-ups von der ersten Finanzierung bis zur Gründung verfolgt hat, bietet uns einige ernüchternde, aber auch vielversprechende Analysen über die Mittelbeschaffung für Start-ups:

Obwohl die Unternehmer und die Investorengemeinschaft weiterhin über die nuancierte Unterschiede zwischen Angel Funding und Seed Funding sind aus der Vogelperspektive praktisch identisch. Bei einem Vergleich und einer Gegenüberstellung von Angel-/Seed-Finanzierung einerseits und Series-A-Finanzierung andererseits werden weitaus gravierendere Unterschiede deutlich. Lassen Sie uns diese erkunden:

Es gibt keinen festen Dollar-Betrag, der eine Seed- oder Angel-Runde definiert. In der Regel handelt es sich jedoch um zehn- bis hunderttausend Dollar und nicht um Millionen (zumindest nicht um viele Millionen). Wenn Sie nach genaueren Zahlen suchen, gibt RocketSpace den Seed-Bereich mit $50.000 bis $2M an. Im Gegensatz dazu gibt RocketSpace die Spanne für die Serie A mit $2M bis $10M an. Natürlich sind Series-A-Runden in der realen Welt wild wuchern. Aber sie sind im Allgemeinen um ein Vielfaches höher als das, was man von einer Seed-Runde erwarten könnte.

Im Allgemeinen ist die erste Runde die schwierigste. Das sollte nicht überraschen. Trotz der geringeren Dollarbeträge stellen Seed- und Angel-Runden das größte Risiko für den Investor dar. Sie haben es daher mit der größten Mittelknappheit und dem härtesten Wettbewerb um diese Mittel zu tun.

Wenn es Ihnen also gelingt, eine Seed- oder Angel-Finanzierung zu erhalten, haben Sie bereits die höchste Einstiegshürde überwunden. In der Serie A werden Sie jedoch mit neuen Herausforderungen konfrontiert, z. B. einer gründlichen Due-Diligence-Prüfung.

Eine Angel/Seed-Runde kann relativ schnell, wenn nicht sogar über Nacht, durchgeführt werden. Das liegt vor allem daran, dass es nur wenige Hürden zu überwinden gilt, zumindest im Vergleich zu späteren, institutionellen Finanzierungsrunden. Wenn Sie jedoch von einer Seed- oder Angel-Finanzierung zu einer Series-A-Finanzierung übergehen, ist es an der Zeit, sich in Geduld zu üben. Aller Wahrscheinlichkeit nach benötigen Sie eine wesentlich längere Anlaufzeit, um die Serie A zu erreichen. Beginnen Sie daher mit der Mittelbeschaffung so weit wie möglich vor der geplanten Finanzierungsfrist.

In einigen Fällen können VCs in den jahrelang am Rande während Sie andere Wege finden, um im Spiel zu bleiben. Daher ist es wichtig, beim Eintritt in die Welt der VCs an langfristige Beziehungen zu denken und nicht an schnelle Deals.

Beim Übergang von der Seed-/Angel-Finanzierung zur Serie A werden sich auch die bewährten Praktiken bei der Mittelbeschaffung drastisch ändern.

Seed- und Angel-Runden verlaufen in der Regel relativ informell und umfassen oft eine lose Reihe von Gesprächen in Cafés oder an anderen öffentlichen Orten. Die Serie A ist eine ganz andere Geschichte. Benannt nach den Vorzugsaktien der Serie A, ist die Serie A die erste wirklich formelle Finanzierungsrunde. Dies wird im Laufe des institutionellen Fundraising-Prozesses immer deutlicher werden.

Um sich auf die Serie A vorzubereiten, sollten Sie unbedingt damit beginnen, Ihre Checkliste für die Sorgfaltspflicht, die sich von nun an als wesentlicher Schritt bei jeder Finanzierungsrunde erweisen wird. In den meisten Fällen müssen Sie in Ihrem Organigramm auch Platz für einen Vorstand und Berater schaffen.

Während einer Seed-Runde werden Sie häufig informelle Plattformen nutzen, um Dokumente mit potenziellen Investoren zu teilen. Wenn sich jedoch alle Parteien einig sind, dass die Sicherheit der Dokumente von größter Bedeutung ist, lohnt es sich, eine virtueller Datenraum (VDR). Dennoch wird ein VDR in der Regel nur als "nice-to-have" für Seed- und Angel-Runden angesehen.

Sobald Sie jedoch die Serie A erreicht haben, ist ein VDR ein nicht verhandelbares Muss. Institutionelle Investoren werden immer erwarten, dass sie Zugang zu einem VDR der Unternehmensklasse um Ihre Unterlagen in einem sicheren Raum zu prüfen.

Einige Investoren bezeichnen Unternehmen, die eine Serie B dass Sie aus der Entwicklungsphase in die Expansionsphase eingetreten sind. Wenn Sie noch weiter in die Serie C vordringen, kann die schnelle Expansion in eine reife Skalierung übergehen. In diesen späteren Runden können auch Fusionen und Übernahmen ins Spiel kommen.

Viele erfolgreiche Unternehmen ziehen vielleicht sogar einen Börsengang in Betracht, um weitere Mittel aufzubringen. Für diejenigen, die es vorziehen, ein privates Unternehmen zu bleiben, aber dennoch Finanzmittel benötigen, werden die Serie C und darüber hinaus wahrscheinlich immer größere Finanzspritzen bedeuten, die oft in zweistelliger Millionenhöhe liegen. Doch mit den weitaus höheren Dollarbeträgen gehen auch weitaus größere Erwartungen an die Marktführerschaft und ein beständiges Umsatzwachstum einher.

Im Allgemeinen nur sehr wenige. Die harte Wahrheit ist, dass die große Mehrheit der Start-ups scheitern, bevor sie eine dritte oder vierte Runde erreichen. Obwohl es also ratsam ist, langfristig zu denken, ist es im Allgemeinen nicht notwendig, mehr als eine oder zwei Runden im Voraus zu planen. Natürlich gibt es immer Ausnahmen.

Wenn Sie z. B. an einem Start-up mit einem mehrjährigen, fertigungsabhängigen Projekt beteiligt sind, wie dem Bau einer besseren Grafikkarte, dann ist es wahrscheinlich am besten, sich mit einem mehrstufigen Investitionsplan im Voraus an eine einzige Gruppe institutioneller Anleger zu wenden. Auf diese Weise können Sie Ihr langfristiges Projekt bis zum Ende verfolgen, ohne dass der Boden auf dem Weg dorthin herausfällt.

Zu wissen, an wen man sich wenden muss und wen man meiden sollte, ist eine der wichtigsten Fähigkeiten, die Sie auf dem Weg in das Labyrinth der Startup-Finanzierung erlernen können.

Es gibt mindestens fünf Faktoren, die Sie berücksichtigen müssen, wenn Sie die Liste der Investoren, die Sie ansprechen wollen, eingrenzen: Ihre Nische, Ihr Wachstumsstadium, Ihr Standort, Ihr berufliches Netzwerk und Ihr Bedarf an Mentoren. Schauen wir uns diese Faktoren genauer an:

Es ist kein Geheimnis, dass Sie sich in Ihrer Branche gut auskennen müssen, wenn Sie um Investoren für Ihr Start-up werben. Es ist jedoch wichtig, Ihre Fundraising-Strategie noch genauer abzustimmen. Sie müssen Investoren finden, die nicht nur an Ihrer Branche, sondern an Ihrer Nische besonders interessiert sind. Um den "Sweet Spot" zu finden, sollten Sie nach Angels, VCs und Firmen Ausschau halten, die kontinuierlich und erfolgreich in Unternehmen investiert haben, die in genau Ihrem Markt tätig sind, aber nicht zu Ihren Konkurrenten gehören.

Sie müssen die Liste der potenziellen Investoren auf Ihre Investitionsphase abstimmen. Es hat zum Beispiel keinen Sinn, einen Angel-Investor zu umwerben, wenn Sie eine Finanzierung der Serie A anstreben. Schließlich ist der Betrag, den Sie aufbringen müssen, höchstwahrscheinlich um eine Größenordnung höher als das, was ein Angel-Investor bieten kann.

Wenn Sie andererseits nur eine Hunderttausend-Dollar-Finanzierung durch einen Engel benötigen, ist es ebenso unklug, eine institutionelle Investmentfirma in der Spätphase zu umwerben, wie Kleiner Perkins.

Im Allgemeinen leben Investoren gerne in der Nähe ihrer Investitionen. Unter Berücksichtigung dieses Grundsatzes ist es am besten, mit der Investorengemeinschaft in der nächstgelegenen Metropolregion zu beginnen. Und trotz aller gegenteiligen Behauptungen ist dies muss nicht das Silicon Valley sein. Zwar gibt es im Silicon Valley tatsächlich mehr Investoren pro Kopf als vielleicht irgendwo sonst auf der Welt, aber es gibt auch viel mehr Unternehmer, die um ihre Aufmerksamkeit konkurrieren.

Außerdem ist die Bay Area ein unerschwinglicher Ort, um zu leben und ein Start-up zu betreiben. Sie können Ihren Investitionsdollar sicherlich weiter strecken, indem Sie vor Ort Gelder beschaffen und gleichzeitig das Wachstum der lokalen Startup-Szene fördern.

Wenn Sie bereits über ein solides berufliches Netzwerk verfügen, das Sie auf LinkedIn oder anderswo anzapfen können, dann ist es an der Zeit, sich darin zurechtzufinden. Arbeiten Sie unermüdlich daran, jede direkte oder indirekte Verbindung, die Sie zu einem qualifizierten Investor haben, aufzudecken.

Wenn Sie über kein großes berufliches Netzwerk verfügen, ist es an der Zeit, eines aufzubauen. Sie können damit beginnen, indem Sie an führenden branchen- und nischenspezifischen Konferenzen teilnehmen, auf denen Investoren häufig nach neuen Interessenten suchen.

Anleger sind alles andere als passive Geldautomaten. Sie wollen oft an jeder wichtigen Entscheidung, die Sie mit ihrem Geld treffen, beteiligt werden. Achten Sie also darauf, einen Investor zu finden, dem Sie vertrauen und mit dem Sie sich gut verstehen.

Im Idealfall sollte der Angel oder VC genug über Ihr Unternehmen und Ihren Markt wissen, um eine vertrauenswürdige Ressource zu sein, und nicht ein aufdringlicher Nörgler. Sehen Sie es einmal so. Wenn Sie in Ihrem Investor einen vertrauenswürdigen Mentor finden, dann haben Sie im Grunde eine neue, erfahrene Führungskraft an Land gezogen, die Ihr Unternehmen so sehr mag, dass sie für Eigenkapital arbeitet.

Denken Sie daran, dass Sie, nachdem Sie alle oben genannten Punkte berücksichtigt und die Liste der Investoren, die Sie ansprechen wollen, eingegrenzt haben, immer noch auf sie zugehen müssen. Da Sie mit Hunderten von anderen um jede Sekunde ihrer Aufmerksamkeit konkurrieren, wird dies harte Arbeit sein, und Sie müssen für die Langstrecke dabei sein. Wie der CEO des Start-ups Bill Radar betont, In der Regel “braucht es Hunderte von Einführungen, Anrufen, Gesprächen und Treffen, um die richtigen Investoren zu finden”.”

Trotz des stärksten Marktes für Startup-Investitionen seit Jahren bleibt die Beschaffung von Startup-Kapital auch 2022 eine Herausforderung. Hier haben wir versucht, Ihnen bei der Bewältigung dieser Herausforderung zu helfen, indem wir uns mit den Schlüsselfragen befasst haben, die den Kern des Risikokapitalfinanzierungsprozesses ausmachen.

Zunächst haben wir uns die Rohdaten angesehen, die ein breites Spektrum von Risikokapitalfinanzierungen von der Startphase bis zum Ausstieg widerspiegeln. Als nächstes haben wir die großen Unterschiede zwischen Angel/Seed-Runden und Series-A-Runden untersucht, einschließlich der Dollarbeträge, des Schwierigkeitsgrads, der Start- und Landebahnen, der Formalitäten und der Praktiken zur Dokumentensicherheit. Dann haben wir untersucht, was nach der Serie A liegt und wie viele Finanzierungsrunden Ihr Unternehmen möglicherweise anstreben sollte.

Schließlich haben wir Ihnen gezeigt, wie Sie Ihre Nische, Ihren Standort, Ihr Investitionsstadium, Ihr berufliches Netzwerk und Ihren Bedarf an Mentoren berücksichtigen können, um Ihre Liste der idealen Investoren einzugrenzen. Wenn Sie all diese Tipps beherzigen und dann in die Praxis umsetzen, sollten Sie gut gerüstet sein, um den aufregenden Sturm zu überstehen, der die Kapitalbeschaffung für Ihr Start-up im Jahr 2022 bedeutet.

Autor

Marketingspezialist mit Schwerpunkt auf der Umsetzung von Erkenntnissen in messbare Geschäftsergebnisse.

Vermeiden Sie die häufigsten Fehler, die Gründer bei der Aushandlung eines Term Sheets mit Investoren machen.

Die Kenntnis der besten Praktiken für die Aushandlung eines Term Sheets ist entscheidend, um das beste Geschäft für Ihr Unternehmen zu erzielen.

Vorlagen für Termsheets helfen Ihnen, die wichtigsten Bedingungen für die Mittelbeschaffung von Start-ups zu verstehen. Holen Sie sich eine kostenlose 7-Tage-Testversion der VDR- und Dokumentensicherheitsdienste von Digify.