From Click to Close: How Document Tracking and Page Analytics Reveal Investor Intent

Discover how document tracking and page analytics can reveal investor intent, boost follow-up timing, and help you close deals faster.

关于数据室、文件安全及其他事项的全面指南

按主题浏览

Discover how document tracking and page analytics can reveal investor intent, boost follow-up timing, and help you close deals faster.

Accurate fund performance reporting is crucial in venture capital for informed investment decisions, regulatory compliance, and building trust with investors.

This article provides a comprehensive, actionable guide to conducting due diligence in M&A. It highlights the best practices, key steps, and tools like VDRs to assist in the M&A process.

Learn the essentials of due diligence in M&A to assess risks, uncover opportunities, and ensure successful transactions.

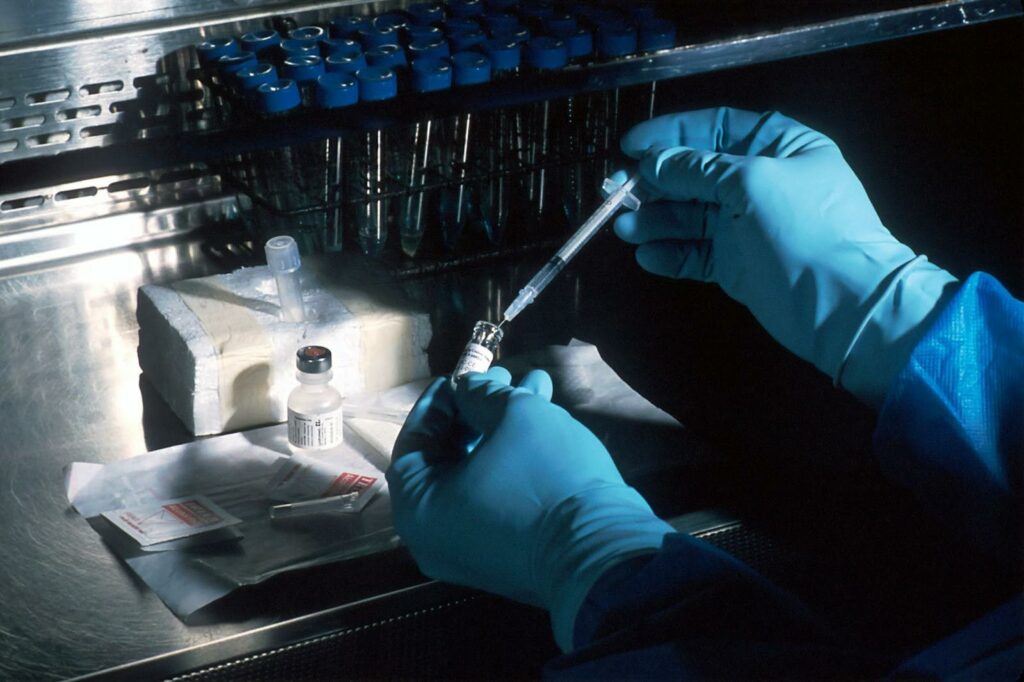

Discover how biotech companies can navigate fundraising challenges while prioritizing data security in an evolving landscape.

In this article, you will learn what virtual data rooms are, how they differ from cloud storage apps and when you should use a virtual data room.

Document tracking allows you to maintain control over who can see the documents and how they can use them.

Learn how to properly set up a data room for due diligence.

Find out why setting up a virtual data room is the best investment you can make before fundraising and due diligence.

Raising venture capital for your company? Hear these important lessons from successful founders who have raised millions in startup funding.

虚拟数据室快速指南:如何为融资交易或投资尽职调查构建数据室架构

确保你的初创企业为A轮融资做好准备:初创企业创始人必备的9条建议。