在尽职调查期间发送初创企业的敏感文件有风险

随着初创企业的发展和投资者的青睐,越来越有必要向投资者发送机密文件。.

潜在投资者可能会要求查看你的初创企业的财务信息、客户名单,并要求获得你的知识产权,以了解他们将投资于什么。当他们评估你的团队时,敏感的员工信息也可能会混入其中。.

随着潜在投资者进行更详细的尽职调查,他们可能希望自己信任的顾问(如律师)也能审查这些文件。所有这些公司财务、专有和知识产权信息的发送都会让你感到紧张。如果处理不当,可能会导致 PDF 和文件被盗,并对公司造成损害。.

您可以通过许多免费或廉价的服务对您的文档和 PDF 文件进行一些控制。但是,只有当你加入文档跟踪功能时,你才能对你的重要文档保持实质性的控制。PDF 和文档跟踪可以让你知道谁在访问你的文档,从哪里访问,访问多长时间。.

PDF 和文档跟踪使您能够保持控制

通过 PDF 和文档跟踪,您可以控制谁可以查看文档以及如何使用文档。此外,您还可以监控他们查看文件的时间和长度。.

有一些方法可以限制他人共享 PDF,使其只能查看。但是,如果你允许他们打印,你就无法控制他们复制并与未经授权的人共享。在 PDF 上设置密码的效果也很有限。收件人可以使用相同的密码从多个设备访问文档,甚至与未经授权的人共享密码。如果不对他们的活动进行跟踪,你就无法知道是否有更多的人用同一个密码访问文档。.

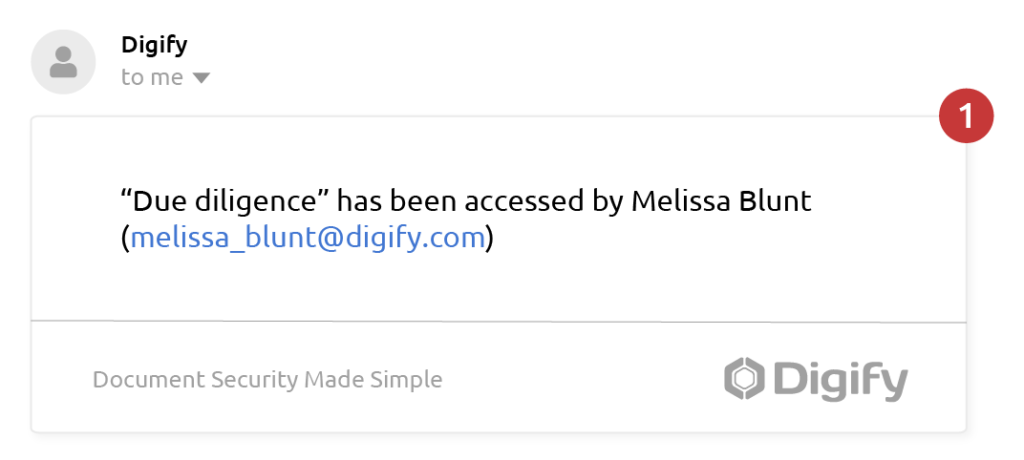

有了 PDF 和文档跟踪功能,当有人访问您的文档时,您就会收到提醒。您还可以监控他们浏览文档的时间,从而获得有价值的见解,以便采取后续行动,确保投资安全。.

虚拟数据室可为初创企业的敏感文件提供最大程度的保护

当你的初创公司进入风险投资阶段时,你必须提出最令人信服的理由,证明你的公司拥有创造有价值回报的商品、人才和能力。要做到这一点,唯一的办法就是提供冷冰冰的硬数据。.

潜在投资者需要了解创业公司的每一个细节。您需要提供敏感文件,这些文件将使您的财务信息、知识产权甚至员工的个人数据面临风险。但这是必须要做的。.

这就是为什么大多数精明的创始人和首席执行官都会选择专业人士的原因。 虚拟数据室 共享文件。有了虚拟数据室,您就可以控制谁可以访问您的文件,以及他们如何共享文件(如果有的话)。.

例如,如果潜在投资者希望将您的财务数据发送给他们的律师审查,他们将需要为该个人申请访问权限。您将有权授予访问权,并监控他们访问数据的时间、地点和时间。.

更重要的是,您可以取消对文档的访问权限。而 PDF 或其他受保护的文档则无法做到这一点。同样,如果投资者认为您的公司不合适,您可以立即撤销他们的访问权限,防止他们与其他企业或投资者共享您的专有信息或知识产权。.

如果您的信息被泄露,您将很快知道泄露方式和泄露者是谁

如果入侵行为严重到足以危及您的业务,您可以立即禁止访问。您还可以掌握证据,对违规者采取法律行动。.

主要收获:PDF 和文档跟踪为何有用

在潜在投资者及其代理人阅读您的文档时,PDF 和文档跟踪可为您带来四大优势:

- 你知道你的跟踪文件会发生什么:您可以知道潜在投资者或第三方何时访问您的文件。您可以看到他们使用文件的时间。您可以知道他们是否打印、下载或与他人分享文件。.

- 您可以撤销共享文件: 通过跟踪,您可以在文件泄露时立即撤销访问权限。.

- 了解他们的兴趣所在:您可以了解潜在投资者对您的哪些文件最感兴趣。然后,您就可以准备解决相关问题或提供更多相关信息。.

- 警惕 “幽灵 ”潜在客户:如果某个潜在投资者突然再次查看您的文件,您将收到提醒,以便重新与该潜在投资者联系。您还可以知道他们访问过或与哪些文件进行过互动,从而为正确的后续行动做好准备。.

关于 PDF 和文档跟踪的常见误解

当你的初创企业在寻找潜在投资以刺激业务增长时,你可能会担心同时承担太多新的责任。因此,您可能会对虚拟数据室和文件跟踪有一些顾虑或误解,例如:

- PDF 和文档跟踪既困难又复杂:随着需要访问贵公司敏感文件的人越来越多,跟踪他们的访问和与文件相关的活动似乎很复杂。.

毕竟,您可能要与多个潜在投资者以及为他们工作和提供建议的所有人打交道。但是,像 Digify 提供的文件跟踪服务可以让您设置参数,让软件来完成繁重的工作,从而消除了复杂性。它还可以提醒您与文件相关的新活动,并生成易于消化的报告,总结与文件相关的活动。.

- PDF 和文档跟踪与电子邮件跟踪是一样的: 有些人认为,电子邮件跟踪可以让他们深入了解和控制敏感文件。但是,您也许可以看到是否有人打开了您的电子邮件并点击了文档链接,但这只是电子邮件跟踪的范围。.

您无法知道潜在投资者阅读您的文件的时间。此外,这样做也不安全--收件人可以在您不知情的情况下随意将您的电子邮件转发给任意多的收件人。.

通过 PDF 和文档跟踪,您可以准确了解谁访问了您的文件、他们的 IP 地址、他们使用文档的时间,以及他们是否与他人共享或试图共享文档。.

使用 Digify 跟踪 PDF 和文档

Digify 通过跟踪确保文档安全。当有人访问您的文档时,您会收到警报,并可随时随地终止访问。.

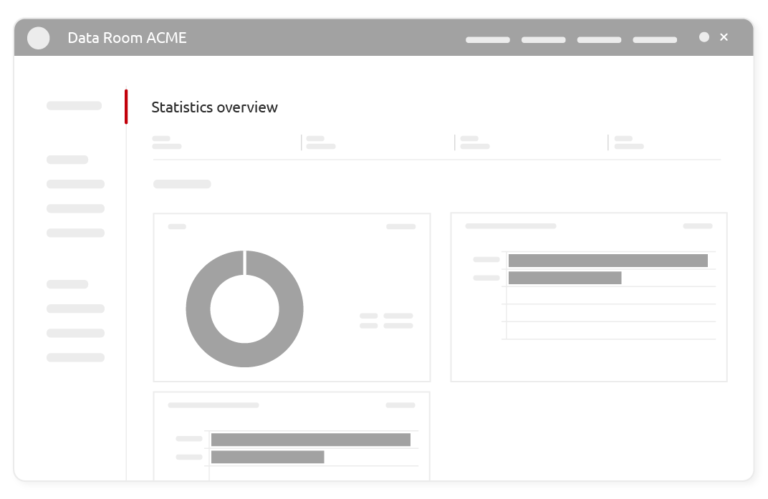

Digify 还能让您在适当的时候跟进投资者。了解他们访问数据室和文件的频率、访问文件的时间以及访问文件的地点。.

生成图形和图表,并将其纳入报告,提供给需要尽职调查过程更新但不需要所有细节的高管或董事会成员。您还可以导出活动日志,以便更详细地了解各方在数据室中处理文件的情况。.

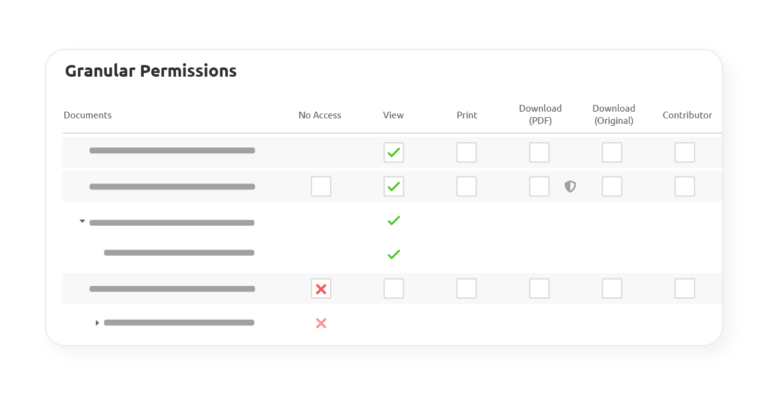

Digify 的虚拟数据室允许您按组或按个人授予文件和文件夹的访问权限。例如,您可以授予财务部门访问某些财务数据的权限,而无需授予他们访问知识产权文件的权限。.

您还可以使用细粒度权限来限制特定个人和群体访问特别机密的信息,并为不同群体和个人定制权限。.

Willy Cheah

作者

营销专家,专注于将洞察力转化为可衡量的业务影响。.

您可能还喜欢