Inhaltsübersicht

Tl;dr

VDR-Funktionen, die Geschäfte wirklich beschleunigen, kombinieren Echtzeit-Tracking und Analysen auf Seitenebene mit granularen Berechtigungen, sodass Sie die Absichten der Investoren erkennen und den Zugriff kontrollieren können. Legen Sie Wert auf ein intuitives Design und reaktionsschnellen Support, anpassbare Markenräume, eine sichere und dennoch reibungslose Freigabe (Wasserzeichen, Verfallsdaten, NDAs zum Durchklicken), umfassende Prüfprotokolle und einen stets aktiven, mobilfreundlichen Zugriff. Abgerundet wird das Ganze mit nativen Integrationen in Tools, die Ihr Team bereits verwendet (CRM, elektronische Unterschrift, Google Mail), um den Aufwand zu verringern und schneller zum Abschluss zu kommen.

Stellen Sie sich vor, Sie haben gerade Ihr Finanzmodell an einen potenziellen Hauptinvestor geschickt. Es vergehen Tage, ohne dass Sie eine Antwort erhalten. Sie wissen nicht, ob er es geöffnet hat, wie viel Zeit er damit verbracht hat, es zu lesen, oder welche Abschnitte seine Aufmerksamkeit erregt haben. Sollen Sie jetzt nachfassen oder riskieren Sie, aufdringlich zu wirken?

Eine VC-Firma in Kalifornien war genau mit dieser Frustration konfrontiert. Ohne aussagekräftige Erkenntnisse blieben sie auf Vermutungen angewiesen, und bei Geschäftsabschlüssen verlangsamen Vermutungen alles.

Ein virtueller Datenraum (VDR) kann dazu beitragen, diese Unsicherheit zu beseitigen. Mit den richtigen Funktionen in Ihrem VDR können Sie den Zeitplan für Ihr Geschäft um Tage oder Wochen verkürzen, indem Sie Reibungsverluste beseitigen, die Transparenz verbessern und schnellere Entscheidungen ermöglichen.

Hier sind die 10 wichtigsten VDR-Funktionen, die die Geschäftsabwicklung beschleunigen, unterstützt durch Erkenntnisse führender Unternehmen.

1. Dokumentenverfolgung in Echtzeit

Wenn Sie genau wissen, wann sich ein Investor oder Käufer mit Ihren Unterlagen befasst, können Sie handeln, solange das Interesse groß ist. Moderne VDRs senden sofortige Warnmeldungen, sobald jemand ein Dokument öffnet oder Zeit darauf verwendet. Diese Transparenz macht das Rätselraten überflüssig und hilft den Teams bei der Priorisierung ihrer Folgemaßnahmen.

Als Tim Pullan, CEO und Gründer von ThoughtRiver, erklärt eine KI-gestützte Plattform, die sich auf die automatische Überprüfung und Analyse von Verträgen spezialisiert hat:

“Es ist wirklich wertvoll, genau zu wissen, welcher potenzielle Investor Zeit mit der Prüfung unserer Unterlagen verbringt, und so zu wissen, auf wen wir uns konzentrieren müssen.”

Für Carrie Chan, Mitbegründerin und CEO von Avant Meats, Eine solche Sichtbarkeit hilft ihr, das Interesse der Investoren abzuschätzen:

“Wenn wir sehen, dass potenzielle Investoren und Kunden unsere Dateien nicht über einen bestimmten Zeitraum hinweg einsehen, können wir davon ausgehen, wie groß ihr Interesse an unserem Unternehmen ist, und bekommen ein besseres Gefühl dafür, wie wir von dort aus vorgehen können.”

Mit diesen Erkenntnissen können Geschäftsteams sofort nach der Überprüfung kritischer Dateien durch einen Stakeholder nachfassen und das Gespräch am Leben erhalten, anstatt tagelang auf eine Antwort zu warten.

2. Analytik auf Seitenebene

Das Öffnen von Dateien ist nur ein Teil der Geschichte. Analysen auf Seitenebene zeigen, welche Abschnitte die meiste Aufmerksamkeit erhalten. Dies hilft den Deal-Teams, die Fragen der Investoren zu antizipieren und schärfere Antworten vorzubereiten.

“Wir bevorzugen Digify, weil wir den Zugang kontrollieren können, genau sehen, wer sich die Inhalte ansieht und wer sie herunterladen kann, und auch eine detaillierte Aufschlüsselung der Statistiken erhalten.”

3. Granulare Benutzerberechtigungen

Nicht alle Beteiligten benötigen die gleiche Zugriffsstufe. Mit granularen Berechtigungen können Sie steuern, wer Dateien anzeigen, herunterladen oder freigeben darf - und wann.

Für Samuel Ramos-Jones, Direktor für Geschäftsentwicklung bei PSA Philippines Consultancy, Digify, der VDR seiner Wahl, hat es seinem Team ermöglicht,:

4. Intuitive Nutzung

Schnelligkeit ist das Ergebnis von Tools, die die Menschen tatsächlich nutzen wollen. Ein VDR sollte sich vom ersten Klick an intuitiv anfühlen, damit interne Teams und externe Stakeholder mit der Arbeit weitermachen können und sich nicht mit der Software herumschlagen müssen. Ein übersichtliches Layout, eine unkomplizierte Suche und einfache Upload-Funktionen verkürzen die Einarbeitungszeit und reduzieren vermeidbare Fehler.

Wenn eine Plattform einfach zu bedienen ist, bedeutet dies auch weniger Bedarf an Kundenunterstützung. Roman Herasymenko, zuständig für Investorenbeziehungen und Finanzen bei Efficient Energy, nutzt Digify aus genau diesem Grund. Wie er erklärt:

“Man muss den Support nicht anrufen, um zu erfahren, wie es funktioniert, weil es sehr einfach zu bedienen ist.”

Eine einfach zu bedienende Plattform verringert auch die Notwendigkeit, den Empfängern der Akten zu erklären, wie sie funktioniert. Bastiaan Malcorps, Koordinator für die Theatrebib-Bibliothek, sagt:

“Dank der Sicherheit und des Komforts, die Digify bietet, können wir jetzt digitale Texte ausleihen. Intuitives Design. Wir haben Hunderte von Kunden und müssen kaum einem von ihnen erklären, wie man Digify benutzt.”

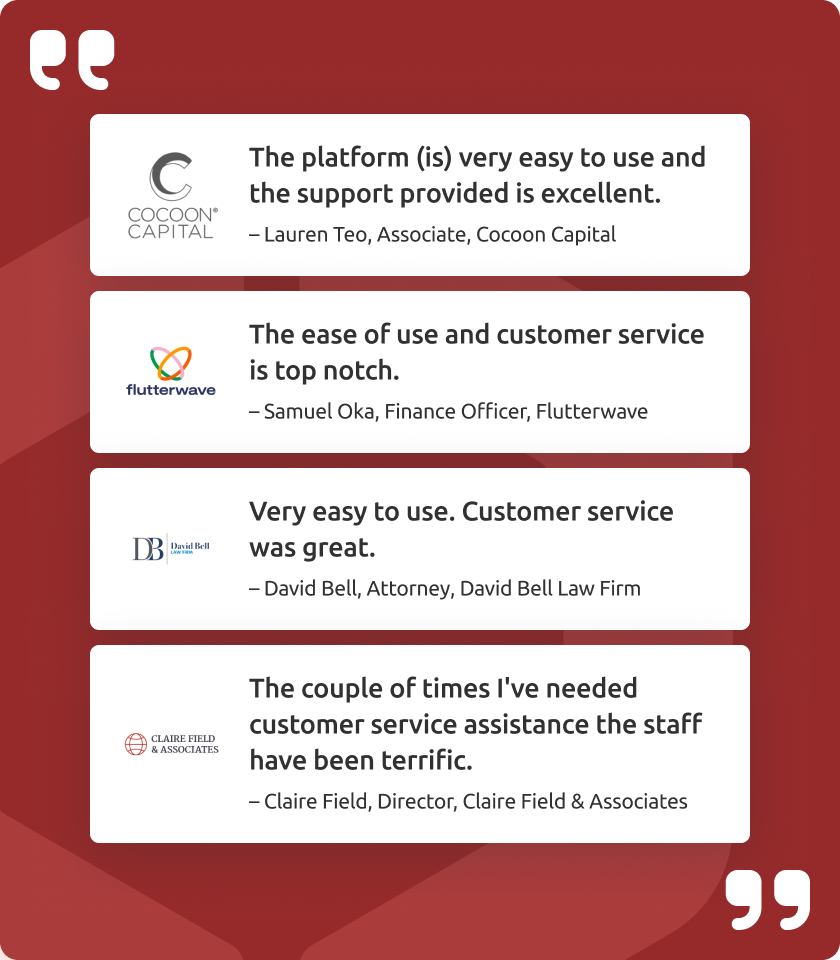

5. Solide Kundenbetreuung

Es ist zwar schön, wenn man keinen Support benötigt, aber wenn die Fristen knapp sind, ist ein reaktionsschneller Kundendienst genauso wichtig wie das Design. Die besten VDR-Anbieter wie Digify unterstützen das Produkt mit schneller, sachkundiger Hilfe, die Zugriffsprobleme löst, Probleme mit Berechtigungen behebt und Fragen zur Einrichtung in Minuten, nicht Tagen, beantwortet. Matt Stadolnik, Finanzmanager bei SiteSpect, sagt:

“Das Support- und Account-Management-Team bei Digify ist unglaublich hilfreich... Sie melden sich proaktiv, um zu sehen, ob ich irgendwelche Fragen oder Bedenken habe.”

Das Ergebnis ist weniger Hin und Her, ein schnelleres Onboarding für Investoren und Berater und ein reibungsloserer Weg vom ersten Anteil bis zum Abschluss. James Costa, leitender Produktmanager bei Wrapbook, der Digify nutzt, sagt:

“Sie reagieren auf das Feedback ihrer Kunden, und ihr Support-Team ist immer auf dem neuesten Stand der Dinge... immer offen für kreative Lösungen für einzigartige Probleme.”

6. Anpassbare Datenräume

Mit dem Fortschreiten der Geschäfte ändern sich die Anforderungen - neue Beteiligte kommen hinzu, neue Dateien müssen ausgetauscht werden, und die Präsentation muss professionell bleiben. Ein VDR, der flexible Berechtigungen, zusätzliche Ordner und ein individuelles Branding ermöglicht, hilft Teams bei der Anpassung nach Bedarf.

Einige Plattformen ermöglichen es Ihnen zum Beispiel, eigene Landing Pages einzurichten, die wie Mini-Websites für LPs oder Käufer funktionieren. – komplett mit Videos, Beschreibungen und maßgeschneiderten Links. So wird aus einer flachen Liste von Dateien ein ausgefeiltes Erlebnis, das die Beteiligten durch die Geschichte des Geschäfts führt.

Für Antonia Korduba, Principal, Leiterin der Investor Relations von G Squared, dies war einer der Hauptvorteile von Digify. Sie sagt:

“Die Digify-Plattform ist von Anfang an so gut in unsere Marke integriert, dass sie den Grundstein für ein nahtloses und konsistentes Erlebnis legt.”

Diese Funktionen verringern die Reibungsverluste für die Anleger und sorgen für ein angenehmese on-brand" und helfen dabei, die Dynamik bei komplexen, anspruchsvollen Erhöhungen aufrechtzuerhalten.

7. Sichere, aber zugängliche gemeinsame Nutzung

Die besten VDRs bieten ein ausgewogenes Verhältnis zwischen absoluter Sicherheit und reibungslosem Zugriff. Das Ziel besteht nicht darin, Dokumente unter Verschluss zu halten, sondern den Beteiligten Vertrauen zu geben und sie in den Prozess einzubinden. Einige Funktionen, die dabei helfen können, sind:

- Wasserzeichen: zum Schutz vor unbefugter Weitergabe, wobei die Anleger die Dokumente bei Bedarf dennoch einsehen oder sogar ausdrucken können. Laut Stacey Shanahan, Senior Controller bei Aurora Insight, Digifys Wasserzeichen-Funktion wurde eine große Zeitersparnis.

“Früher musste ich jede einzelne Datei in verschiedenen Formaten manuell mit einem Wasserzeichen versehen, aber mit Digify ist der gesamte Prozess jetzt effizienter.” - Verfallsdaten: die es Ihnen ermöglichen, zeitlich begrenzten Zugriff zu gewähren, um sicherzustellen, dass sensible Materialien nicht unbegrenzt offen bleiben, und um spätere manuelle Widerrufe zu vermeiden. Als Will Klippgen, geschäftsführender Gesellschafter und Mitbegründer von Cocoon Capital sagt,

“Wir können Digify problemlos nutzen, um vertrauliche Präsentationen mit voreingestellten Zeitlimits zu versenden.”

Er weist darauf hin, dass diese Funktion eine einfache Möglichkeit bietet, den Zugriff auf einzelne Dokumente zu gewähren und bei Bedarf zu widerrufen. - NDAs zum Durchklicken: die es neuen Beteiligten leicht machen, schnell Zugang zu erhalten, ohne den Prozess des rechtlichen Hin und Her zu verzögern.

Diese Funktionen gewährleisten die Sicherheit der Informationen, ohne dass dies auf Kosten der Geschwindigkeit geht. Die Beteiligten erhalten mit minimalen Reibungsverlusten den Zugriff, den sie benötigen, und die Geschäftsteams behalten in jeder Phase die Kontrolle.

8. Prüfpfade und Aktivitätsprotokolle

Audit-Protokolle sind mehr als ein Kontrollkästchen für die Einhaltung von Vorschriften – Sie sind eine detaillierte Aufzeichnung aller im Datenraum durchgeführten Aktionen, z. B. wer wann und wie lange auf welche Dateien zugegriffen hat. Wie Stephen Grant, Der Gründer und CEO von Kinetic Capital führt aus:

“(Die Empfänger) können nicht behaupten, sie hätten etwas nicht erhalten, wenn alles da ist. Sie erhalten einen großartigen Prüfpfad und können nachvollziehen, wer was mit Ihren Dokumenten macht.”

Diese Transparenz ist auch in regulierten Branchen von entscheidender Bedeutung, in denen Unternehmen in der Lage sein müssen, die Kontrolle über sensible Informationen nachzuweisen. Denn Aufsichtsbehörden wie die SEC verlangen von Vermögensverwaltern und Finanzinstituten nicht nur den Nachweis, dass sie vertrauliche Dokumente schützen, sondern auch, dass sie eine prüfbare Historie darüber vorlegen können, wer wann und mit welchen Berechtigungen auf sie zugegriffen hat. Andernfalls riskieren die Unternehmen Verstöße gegen die Vorschriften, Rufschädigung und mögliche Geldstrafen.

Aber es verschafft den Deal-Teams auch einen taktischen Vorteil, denn es hilft ihnen zu verstehen, wo sich die Stakeholder in ihrem Prüfungsprozess befinden.

9. Ständig verfügbarer, komfortabler Zugang

Geschäftsabschlüsse werden nicht nur nach Büroschluss getätigt; Investoren und andere Beteiligte müssen die Möglichkeit haben, Dokumente einzusehen, wann immer es ihnen passt. Deshalb sind die besten VDR-Lösungen so konzipiert, dass sie den Zugriff über verschiedene Geräte und Systeme hinweg erleichtern, ohne dabei die Sicherheit zu beeinträchtigen.

Grant, der Digify nutzt, sagt:

“Wenn ich denke: ‘Habe ich einen Ordner oder eine Datei übersehen?’ oder wenn ich etwas nachschlagen möchte, kann ich das sehr schnell auf meinem Telefon tun, und es funktioniert sehr gut.”

10. Integration mit bestehenden Tools

Getrennte Systeme verlangsamen alle und alles. Ein VDR sollte nahtlos mit CRM-Systemen, Tools für elektronische Unterschriften und Plattformen für die Zusammenarbeit verbunden sein, damit Teams ohne Kontextwechsel in Schwung bleiben können.

Für Jonathan Agha, VP für Informationssicherheit bei WeWork:

“Digify ist ein einfaches und sicheres Tool, das die notwendige Integration in die von uns bereits genutzte Infrastruktur bietet. Daher war es eine klare Entscheidung, Digify für unsere internen Teams auszuwählen und einzusetzen.”

Ein Beispiel für diese Nahtlosigkeit ist Die Gmail-Integration von Digify, mit der Sie Ihre Dateien direkt im Posteingang verwalten können. Nach der Installation einer Chrome-Erweiterung hängen Sie einfach verfolgbare, verschlüsselte Dateien an, während Sie eine neue E-Mail verfassen. Sie können dann entscheiden, wer Zugriff erhält, Download-/Druckberechtigungen verwalten und Ablauffristen festlegen, und wie gewohnt mit intelligenten Links versenden.

Sie können auch sehen, wer die Dateien wie oft angesehen hat, und über die Funktion ‘Track & Unsend Anytime’ sogar Anhänge jederzeit abbestellen. Der optionale Passkey-Schutz und die AES-256-Verschlüsselung sorgen dafür, dass sensible Dateien unter Verschluss bleiben, ohne dass die Mitarbeiter aus ihrem E-Mail-Workflow herausgerissen werden. Elliot Bourne schätzt die Zeit, die auf diese Weise eingespart werden kann, und erklärt:

"Mit dieser Erweiterung ist es viel einfacher, Dokumente zu sichern. Eine echte Zeitersparnis."

Merkmale in einen Vorteil verwandeln

Bei schnellen Geschäftsabschlüssen geht es nicht darum, einen potenziellen Kunden zum Kauf zu drängen, sondern darum, Reibungsverluste zu vermeiden, damit er sich bei Ihnen wohl fühlt.

Der richtige VDR verwandelt langsame, manuelle Schritte in optimierte Arbeitsabläufe. Von Warnmeldungen, die zu rechtzeitigen Folgemaßnahmen führen, bis hin zu Integrationen, die sich wiederholende Arbeiten vermeiden, hilft ein moderner VDR den Teams, den Schwung beizubehalten.

Digify vereint all diese Fähigkeiten in eine sichere VDR-Plattform für Schnelligkeit gebaut. Mit Digify gewinnen Sie an Transparenz, bleiben organisiert und können selbstbewusst einen schnelleren Abschluss anstreben.