Emerging Trends: AI, ESG, Tokenization, and Fundraising in a Volatile Market

Discover how AI, ESG, and blockchain tokenization converge with strategies for fundraising in volatile markets to shape the future of private equity.

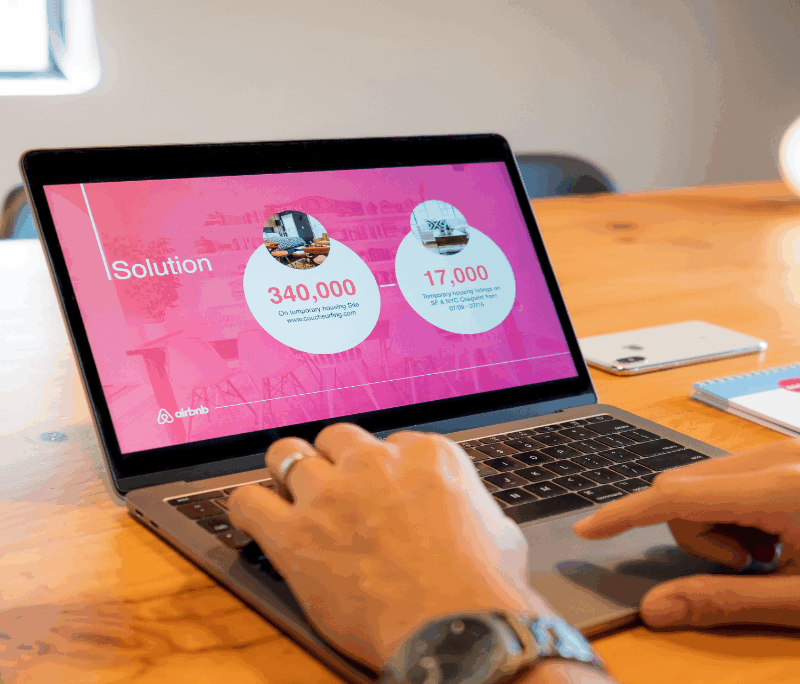

Learn how to tackle common pitch deck problems and actively track your startup pitch deck engagement for fundraising success.

We all know how important first impressions are. Even before the actual investment, a well thought-out pitch deck can help you get a coveted meeting with the right investors.

A typical VC is probably used to seeing hundreds of decks every year, and may only take 2 to 5 minutes to read before deciding whether to move forward with a founder. Thus, it’s important to keep your deck short and sweet. This means keeping the presentation PDF simple and avoiding cluttered slides with long text.

One thing is certain: the most successful pitch decks have a cohesive and compelling story. You need to structure the narrative well, with each slide advancing the story about the opportunity you are offering.

That said, here are a few problems you might face when sharing startup pitch decks with investors.

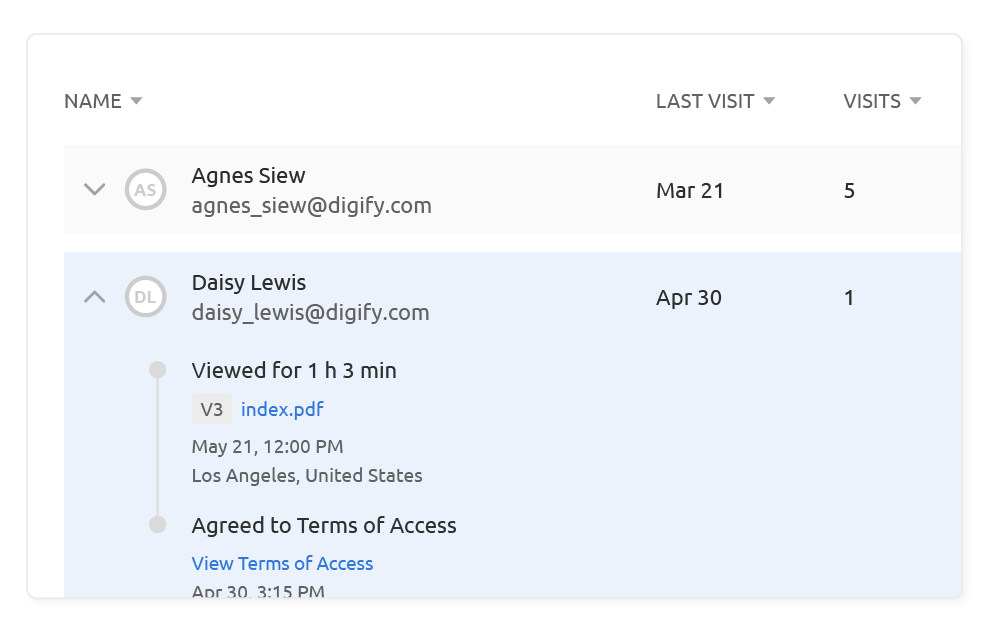

If you send a pitch deck via an email attachment, it’s impossible to tell if an investor has opened and engaged with your document. Thus, it’s important to use PDF & document tracking tools to understand how your deck is performing and if you are on the right track to close a deal.

With PDF & document tracking, you can immediately track and see how recipients interact with your pitch deck and who spent the most time with it. There are several ways to leverage these insights in real time.

For example, Dutch startup Autofill Technology was able to use document tracking analytics to determine which documents investors are spending the most time with. This gives them a good idea of what part they need to elaborate and focus on in their pitches.

“Just the fact that people are accessing our documents means they are interested. That gives us a good indication of where we are and what’s going to happen.”

– Stefan Verhoeven CFO and Co-founder, AutoFill Technologies

If an investor opens your pitch deck repeatedly, they will almost certainly be more interested than an investor who has never opened it. Use such valuable insights from PDF & document tracking to strategically plan and tailor your follow-ups to the right people, at the right time.

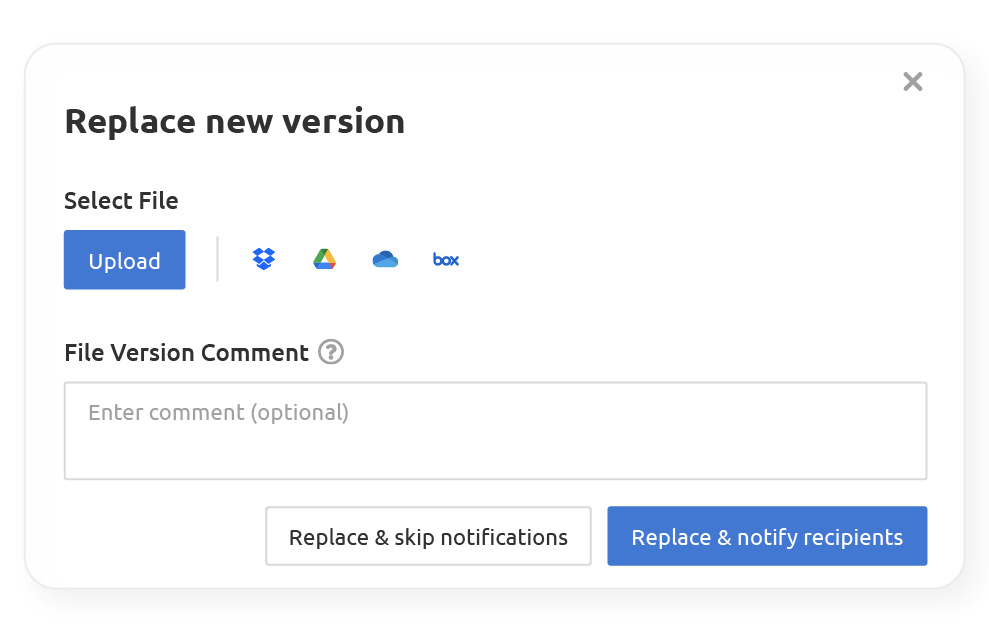

We’ve all been there. If you spot a typo, or need to make changes to your pitch deck, you can actually avoid the hassle and embarrassment of apologizing to investors. Simply use a platform with file versioning features to replace your pitch deck.

Of course, with every successful fundraising round comes a number of rejections by investors. You should always keep your expectations in mind, because it is more common to hear a “no” than to receive a “yes.”

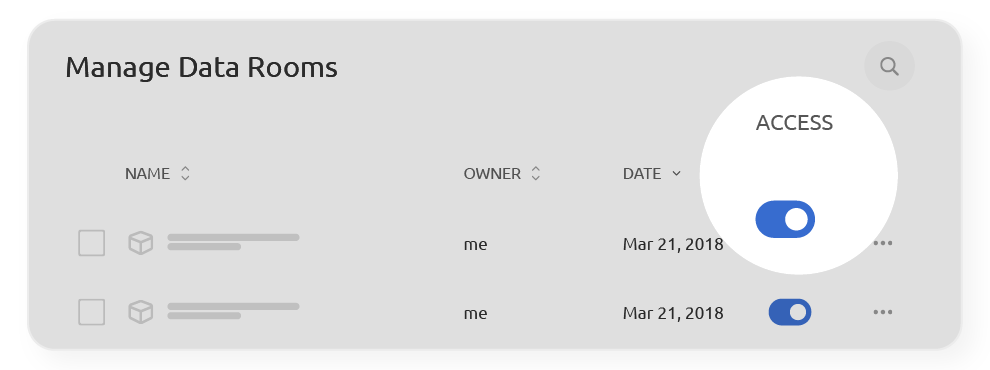

If an VC or investor is clearly not interested in further contact, make sure you have the ability to disable access to your PDF pitch deck with a simple click. You do not want people who no longer need it to continue to have access to your intellectual property, so it does not fall into the wrong hands.

Now that you are aware of the common pitfalls faced by founders who send pitch decks to multiple investors, use the solutions above to work smarter and track your pitch deck and PDF documents for successful fundraising. It’s as simple as it sounds.

With Digify, your investors do not even have to verify themselves, they can view your deck instantly upon invite. If an investor is interested in learning more details during the due diligence phase, you can also follow up with Digify’s virtual data rooms. Don’t have a Digify account yet? Sign up today for a free 7-day trial, no credit card required.

Author

Marketing specialist focused on turning insights into measurable business impact.

Discover how AI, ESG, and blockchain tokenization converge with strategies for fundraising in volatile markets to shape the future of private equity.

Learn how to structure fund closes, simplify subscription docs, and set up follow-on fundraising.

Create fundraising materials like PPMs, pitch decks and data-driven market analysis to streamline due diligence and raise funds faster.