The data room that investors actually like

From early raises to billion-dollar exits, Digify helps you close with confidence.

No credit card needed

Trusted by PE & VC firms managing billions in AUM

$9B AUM

$4B AUM

$3B AUM

$4B AUM

Trusted by Startups to raise millions

$963M

$489M

$210M

$63M

$59.1M

$30M

$2.4B

$40M

Trusted for high-stakes M&A transactions

Because great investor experiences win deals

Easy access for recipients

“Digify has all the features you need and seems very easy to use from the ‘outside’ users’ point of view. Several customers commented on how easy they found it to use.”

J. Matthew Pryor

Tenacious Ventures

Friendly, human support

“The support and account management team at Digify is incredibly helpful as well. They proactively reach out to see if I have any questions or concerns.”

Matt Stadolnik

SiteSpect

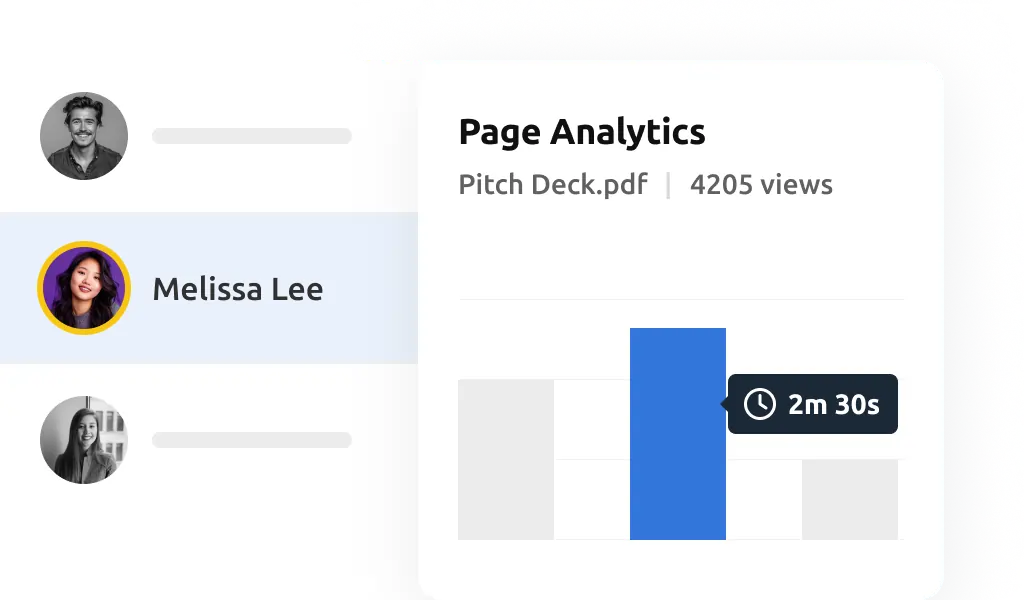

Better, more timely investor conversations

“Digify’s real-time document tracking helped me time a follow up call perfectly, catching a VC right after they reviewed our financials, which led to a $500K funding commitment.”

Patrick Clifford

Best in class branding features

“Highly recommend. It is very efficient to upload and update documents as well as personalize with branding. We also like that we can track our visitors.”

Afton M

The VDR for dealmaking

Fundraising

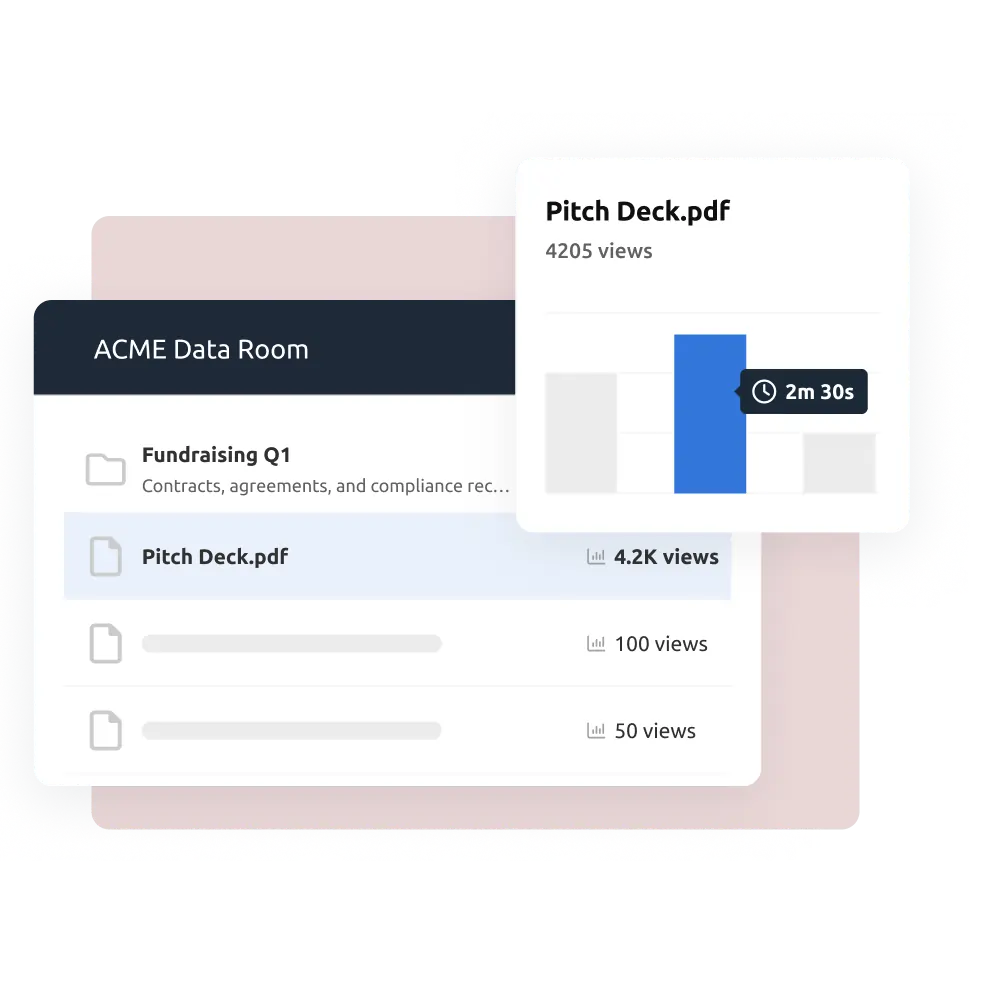

Send your pitch deck to many investors at once, without losing control. See who viewed your deck, which slides mattered, and who to follow up with.

Due diligence

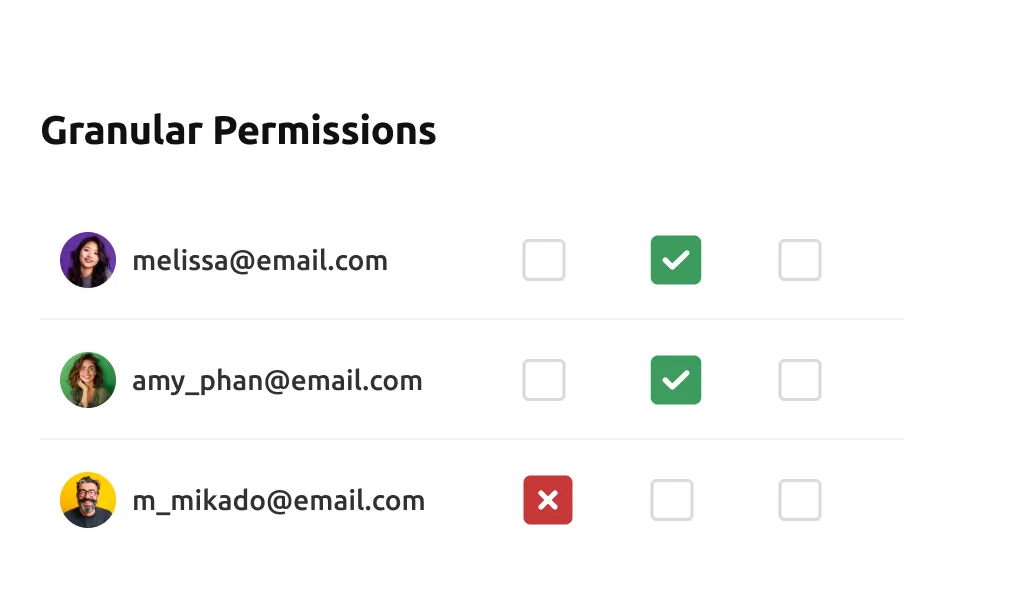

Organize your deal documents into folders, control who sees what, and watermark everything automatically. Track every click with audit trails.

Investor updates

Digify VDRs help you share branded, trackable documents at scale, so your investors get what they need, and you know exactly who’s engaged.

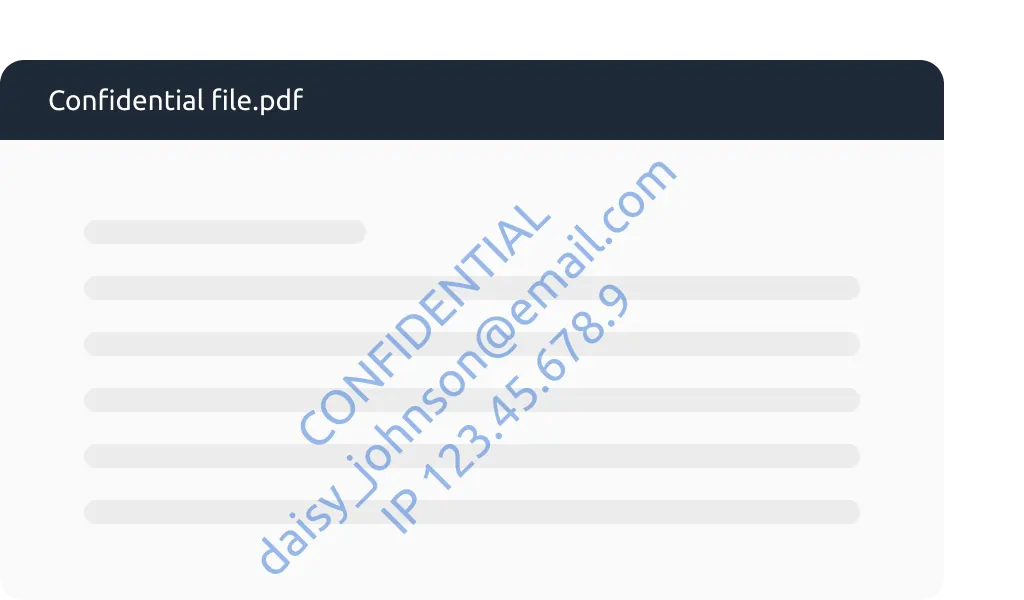

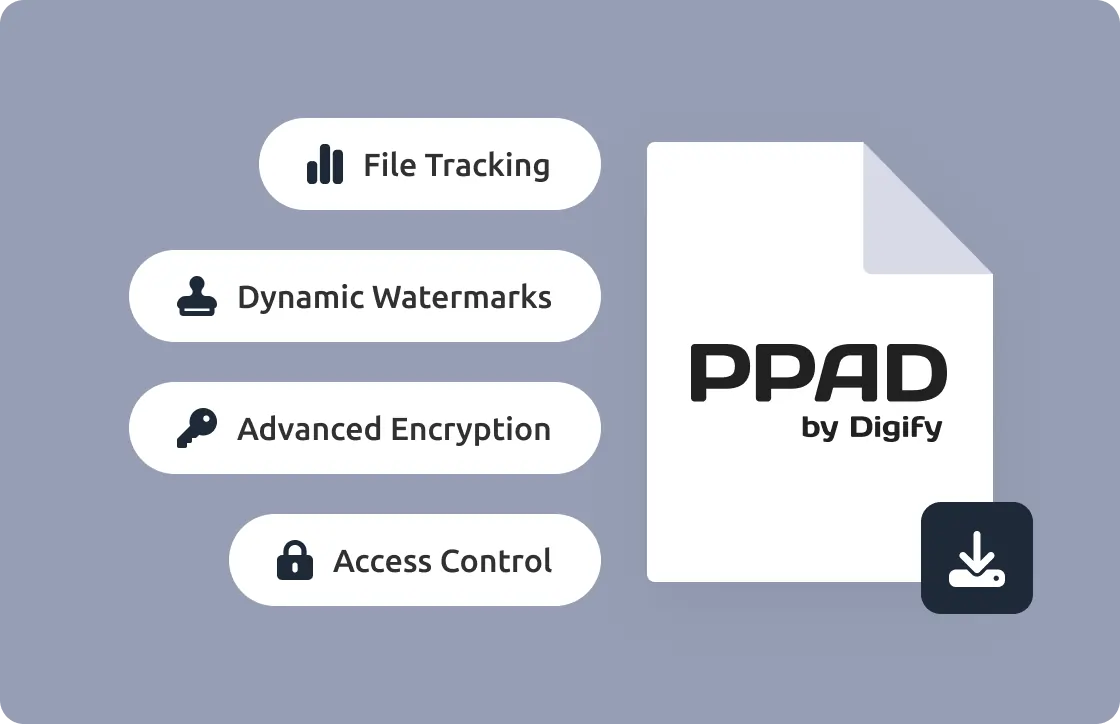

Protect files after download. Only with Digify.

Digify’s Persistent Protection After Download (PPAD) feature lets recipients download the entire data room for easier access.

You can still revoke or set file expiry, block printing/forwarding, and see every open and reopen.

The data room with just the right features

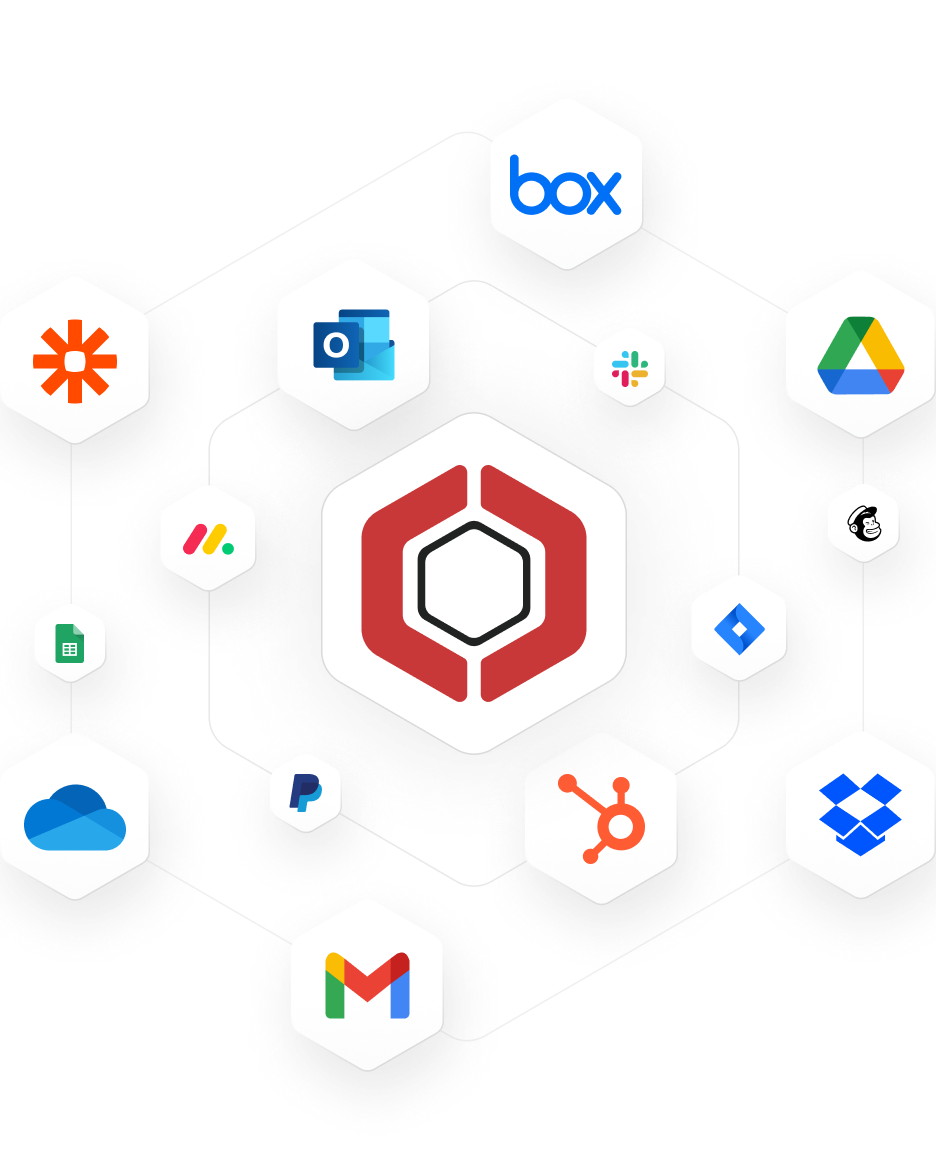

Streamline your deal flow with integrations

-

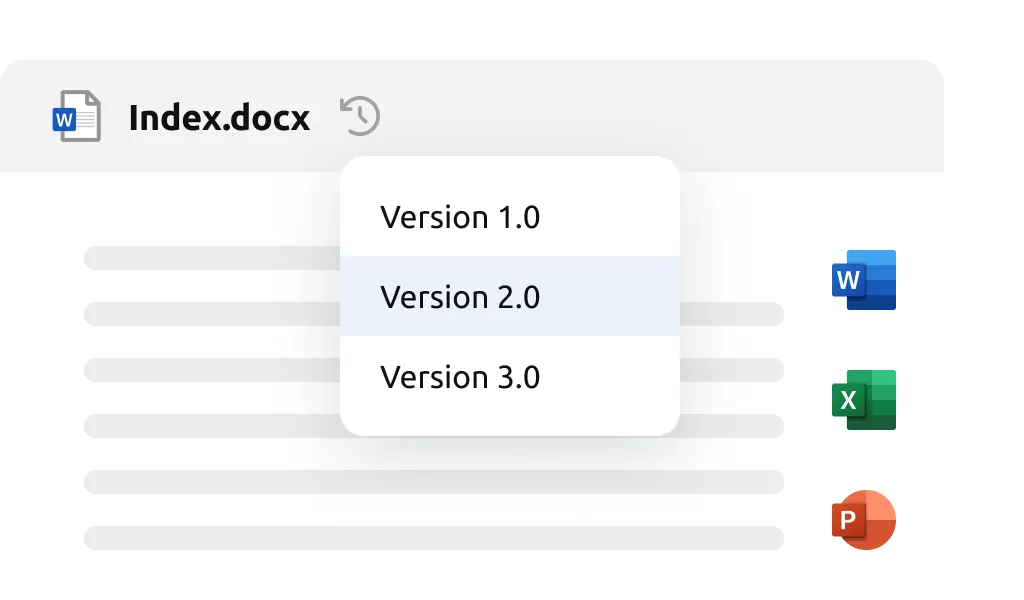

Edit with Office 365 inside the Digify platform

-

Sync files from Box, Google Drive, Dropbox & OneDrive

-

Protect email attachments in Gmail & Outlook

-

Track engagement in Salesforce & HubSpot

-

Connect 8,000+ apps via Zapier or use our API

Secure, compliant dealmaking

Digify is ISO 27001 certified and compliant with GDPR and HIPAA. We use AES-256 and RSA-2048 encryption.

-

Patent-pending DRM — retain file control, even after data room download

-

Choose your data region — file residency in USA, Canada, Australia, UAE, Indonesia, India, Singapore, UK, and Ireland

-

Single Sign-On (SSO) and robust permission APIs — built for scale

Trusted by over 700,000 professionals

“Digify is a simple yet secure tool that provided the necessary integration with the infrastructure we already use. This made picking and using Digify for our internal teams an obvious decision.”

Jonathan Agha

Former Head of Information Security

WeWork

“The interface, access controls are all very intuitive. I am able to see granular level data on document access and review. It helps provides information for insights into how a diligence process is operating. The integration with Gmail is also very useful to regularly send secure emails without leaving the gmail interface.”

Arjun Sharma

Director, Legal

Peak XV Partners

“We’ve been using Digify for the last year to help securely send private documents to external partners. Their product saved us a lot of time from having to build our own tool to securely share these documents. Their product is feature rich, they respond to customer feedback, and their support team is on top of things always open to creative solutions to unique problems.”

James Costa

Principal Product Manager

Wrapbook

“Digify demonstrated it was the most innovative by highlighting a simple and inexpensive way to address a recurring challenge of controlling and protecting ideas and information.”

Hugh Thompson

CTO, Symantec Head Judge

RSA Innovation Sandbox

“We use Digify to securely send sensitive documents as part of due diligence processes and security reviews. We like to keep our confidential documents close to the chest. With Digify, we are always in control of who has access and who doesn’t.”

Jonathan Dunlop

Formal General Counsel

Vidyard

“We love that we can provide our prospective and active portfolio company with secure data rooms and also that we easily can use Digify to send confidential presentations with preset timeouts. Digify creates a simple way to give and to revoke access to individual documents as needed.”

Will Klippgen

Managing Partner & Co-founder

Cocoon Capital

“We always use Digify to maintain a data room for investors so that sensitive information is still protected, even when it is sent externally. I’m very likely to recommend Digify for its ease of use and of course, the security.”

Jonathan E. Savoir

CEO & Co-founder

Quincus

A Virtual Data Room (VDR) is a secure online platform for storing and sharing sensitive documents during fundraising, M&A, due diligence, and other confidential workflows. Unlike standard file-sharing tools, VDRs are purpose-built for deals, offering access control, activity tracking, and document protection features not available in tools like Google Drive or Dropbox.

A Virtual Data Room (VDR) is used to securely share and manage sensitive business documents during important transactions.

It is commonly used for:

- Mergers and acquisitions (M&A)

- Fundraising and investor due diligence

- Legal and compliance processes

- Audits and financial reporting

- Secure collaboration with external parties

In short, a VDR helps businesses control access to confidential information when security and transparency matter most.

Using a Virtual Data Room (VDR) makes it easier and safer to share confidential business documents.

Key benefits include:

- Stronger security for sensitive files

- Full control over access and permissions

- Activity tracking and audit logs for transparency

- Faster due diligence and deal workflows

- Reduced risk of document leaks, even after download

A VDR provides the protection and oversight businesses need when handling critical transactions.

Virtual Data Rooms are widely used in industries that handle sensitive documents and high-value transactions.

Common industries include:

- Investment banking and private equity

- Mergers and acquisitions advisory

- Legal services

- Real estate and construction

- Healthcare and life sciences

- Startups and fundraising teams

- Corporate finance and compliance

Any organization that needs secure document sharing and strict access control can benefit from a VDR.

A Virtual Data Room (VDR) is different from Dropbox or Google Drive because it is built for sharing highly confidential business documents during sensitive transactions.

Unlike regular cloud storage, a VDR provides:

- Stronger security and permission controls

- Full activity tracking and audit logs

- Protection even after download (such as encryption and access restrictions)

- Better document organization and management

- Deal-ready tools for M&A, fundraising, and due diligence

In short, Dropbox and Google Drive are for everyday file sharing, while a VDR is designed for secure, high-stakes business use.

The cost of a Virtual Data Room (VDR) is usually based on a few key factors, such as the number of users, storage volume, and the level of security and support required.

Most VDR providers follow pricing models like:

- Subscription-based plans (monthly or yearly)

- Per-user pricing for larger teams

- Usage-based pricing depending on storage or deal activity

- Enterprise packages for complex or high-volume transactions

Digify offers a subscription-based pricing model starting at $140 per month, with higher-tier plans available to support additional users, data rooms, and advanced security features.

This flexible model allows businesses to scale based on the size of each project.