10 Features to Look for in a VDR that Speed Up the Dealmaking Process

10 must-have virtual data room (VDR) features to speed deals: real-time tracking, page analytics, granular permissions, audit trails and integrations.

This article provides a comprehensive, actionable guide to conducting due diligence in M&A. It highlights the best practices, key steps, and tools like VDRs to assist in the M&A process.

Today, M&A deals involve thousands of confidential documents that need to be shared and reviewed by multiple parties simultaneously. Dealmakers need support during these complex deals to optimize and accelerate their M&A processes.

While global Mergers and Acquisitions (M&A) activity is showing early signs of recovery from last year’s dip, dealmakers face intensifying regulatory scrutiny and geopolitical uncertainties, which can slow down deal completion.

Consider this: the average M&A deal takes 6-12 months to complete, with data management being a critical factor in these timelines. According to BCG’s M&A Report, approximately 40% of transactions end up exceeding their estimated closing timelines.

So, how can dealmakers speed up these processes?

With the M&A process becoming increasingly complex and data-intensive, efficient virtual data room (VDR) management is now more crucial than ever. Optimizing your data room management isn’t just about organization — it’s about maintaining deal momentum and accelerating value creation in a complex deal environment.

Here are four actionable tips that can optimize your M&A data room and accelerate your M&A process.

A well-structured data room speeds up dealmaking by reducing the time buyers spend searching for information and minimizing redundant information requests. When buyers can quickly locate and review documents in a logical order, they can conduct due diligence more efficiently, leading to faster decision-making and reduced transaction timelines.

Start by mapping out your main folder categories to align with standard due diligence request lists:

Within these categories, create intuitive subcategories. For example, “Financial Information” should include:

The key is striking the right balance in your folder hierarchy. While too many layers can become confusing, too few can result in cluttered folders that are difficult to navigate. Aim for no more than 3-4 levels of hierarchy for rapid navigation while maintaining sufficient organization.

Ineffective access controls cause delays in the M&A process and increase the risk of information leaks that could jeopardize the transaction.

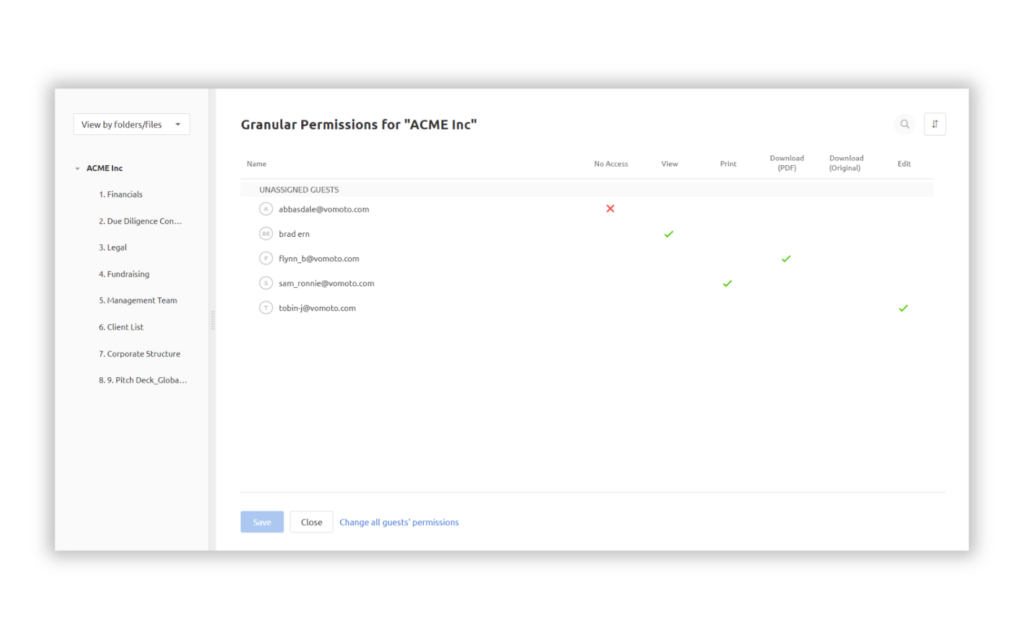

Your virtual data room needs to enable immediate and appropriate access for all file recipients. Proper access controls and permissions reduce time spent managing access requests and facilitate smooth transitions between deal phases.

Map out different user groups involved in the deal process and their required access levels. Consider how these access controls and specific permissions can change throughout stages of the M&A process.

As well as security, robust access control creates an efficient, staged disclosure process that aligns with your deal strategy.

Pro Tip: Once you have established the access and permissions for different user groups in your M&A data room, it’s important that you plan your disclosure strategy.

Progressive disclosure is crucial in the M&A process to maintain deal momentum. Instead of making all documents available immediately, release information in strategic phases.

This approach maintains competitive tension while protecting sensitive information until appropriate NDAs are in place and buyer interest is confirmed.

Data room analytics provide crucial insights into buyer engagement and deal progress. Understanding how buyers interact with your data room allows you to make informed decisions about follow-up, additional information needs, and potential issues. These data-driven insights can accelerate decision making and reduce overall deal time. Key metrics to track include:

When monitoring user engagement, track activity at both group and individual levels. Document access patterns reveal which teams are most thoroughly engaging with your data room contents.

Several key behavioral indicators can help you identify serious potential buyers.

Pro Tip: Analytics should directly inform how deal team resources are allocated. Priority attention should be directed toward the most engaged buyers, as indicated by their activity levels and interaction patterns.

Response protocols should be weighted toward active reviewers who demonstrate serious interest through their behavioral patterns. Subject-matter-expert (SME) time should be allocated based on observed activity patterns and areas of buyer focus. Schedule follow-up meetings and additional information sessions based on engagement data and demonstrated areas of interest or concern.

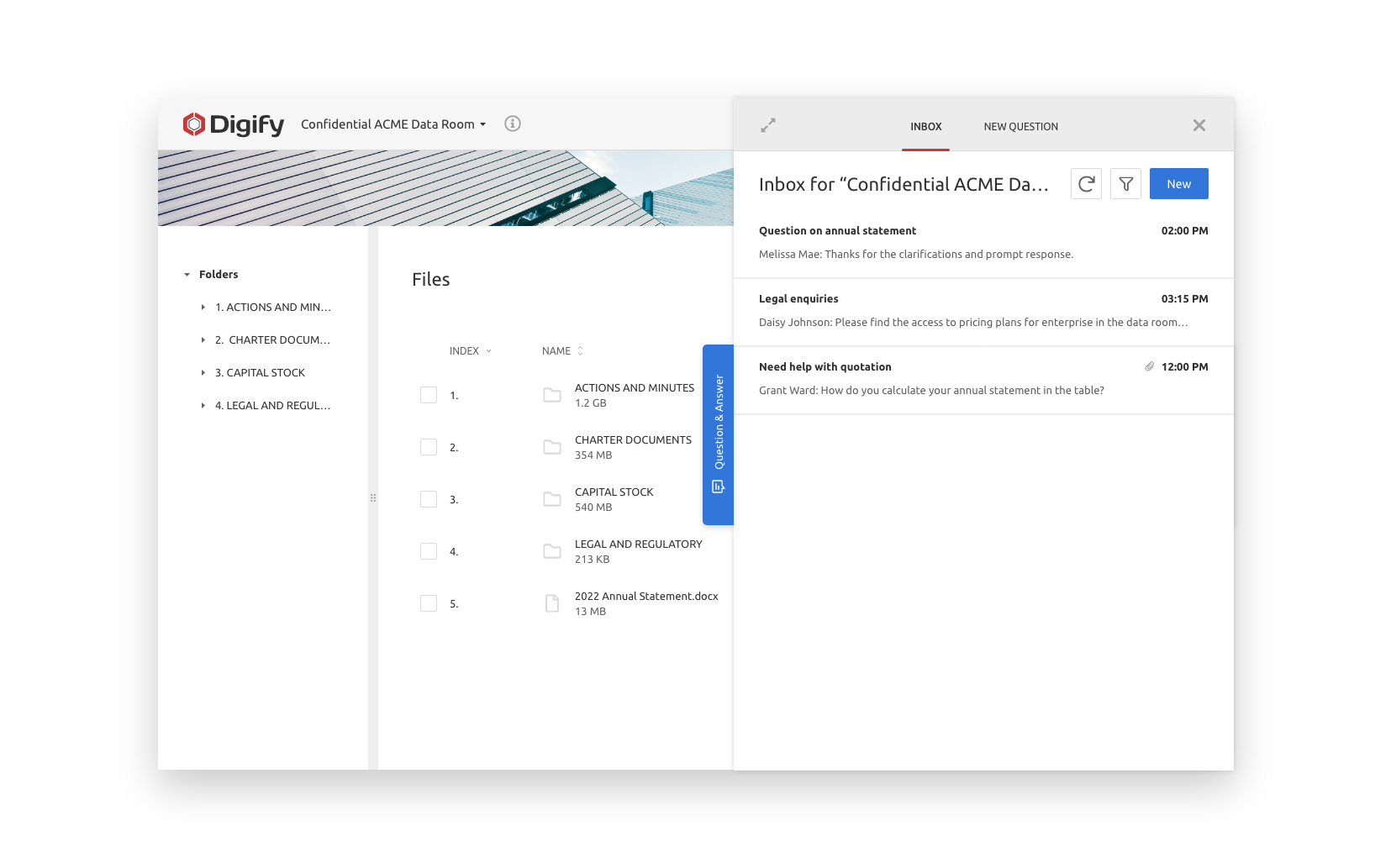

An efficient question and answer (Q&A) system during due diligence processes reduces deal timelines and improve buyer engagement. M&A data rooms with built-in Q&A functionality decrease response time from days to hours and enable parallel processing of multiple inquiries.

To maximize efficiency, set clear Q&A protocols, such as:

Monitor and analyze Q&A patterns to improve the M&A process and track FAQs to identify and plug information gaps. Multiple questions about specific contracts often indicate potential deal concerns. For instance, repeated financial queries may suggest gaps in initial disclosure.

Pro Tip: You can use question patterns to anticipate additional document requirements. Technical questions about systems often precede integration planning, while HR-related questions typically spike before deal announcement. Getting these documents ready and organized in your data room will help speed up your M&A deal.

While these four tips provide a framework for accelerating your M&A process, implementing them effectively requires the right virtual data room solution. This is where Digify makes a significant difference.

Digify offers a comprehensive solution for managing your M&A process efficiently. Our intuitive virtual data rooms are easy to set up for securely sharing documents throughout the deal process, and tracking who has viewed each file. Digify simplifies communication and engagement with investors while ensuring enterprise-grade security for distributing documents at scale.

Companies including G Squared and JLL have successfully managed their due diligence processes using Digify’s secure and intuitive platform.

Experience the difference yourself with our 7-day, obligation-free trial.

Author

Marketing specialist focused on turning insights into measurable business impact.

10 must-have virtual data room (VDR) features to speed deals: real-time tracking, page analytics, granular permissions, audit trails and integrations.

Learn how modern virtual data rooms, engagement analytics & digital tools streamline private-capital fundraising, secure documents, and close deals faster.

Bringing together security and convenience, virtual data rooms (VDRs) today have become the go-to solution for sharing and collaborating on sensitive documents. Features like encrypted file storage, detailed permission management, dynamic watermarking and granular analytics of how guests are interacting...